INVESTMENT BANKING HOUSE

INVESTMENT THAT WILL MAKE YOU GROW.

Investment Banking House is a financial service company or division of a bank that provides advisory services to individuals, and corporations in relation to underwriting, capital raising, merger, and acquisition, etc.

TYPES OF INVESTMENT BANKING

Regional Boutique

Smaller in size, they deal with not more than a dozen customers and specializes in a single area.

Elite Boutique

Elite boutiques represent how the old school investment banks had once operated and long term wealth creation and trading.

Middle Market

They deal between 50L to 80L, have a larger presence than regional market division, and have little presence in market.

Greater Investment

Investing in multinational companies allows us to increase our investment returns.

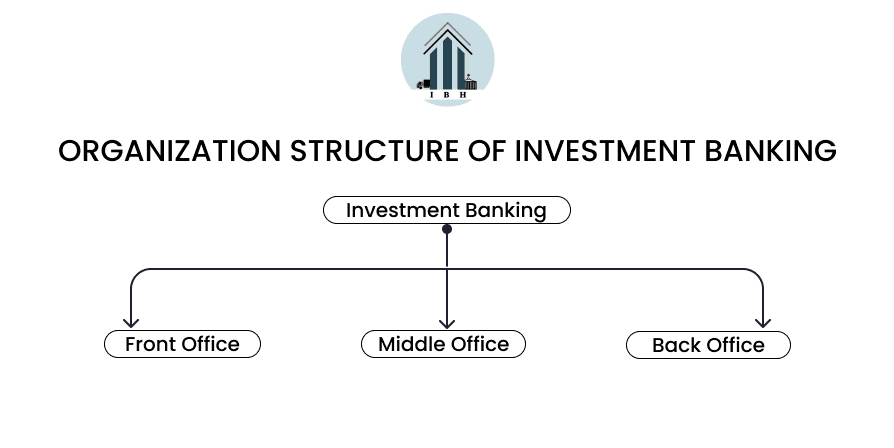

STRUCTURE OF INVESTMENT BANKING

Today, everyone should invest in mutual funds. There are three levels of mutual funds.

Front Office

People in this division face customers directly.Activities include advisory services on merger & acquisitions.

Middle Office

People in this division are responsible for information technology and risk management related services

Back Office

Back office staff deals with customer services, human resources, office management, staff payroll, etc

WHY INVESTING IN A MUTUAL

FUND IS A WISE CHOICE

-

Diversification

- Immediate diversification.

- pooling money from thousands of similar investors.

- unlikely all the stocks will go down single day.

-

Professional Management

- Professional expertise provides for your investments.

- Asset Management Companies (AMCs) provide qualified fund managers.

- Saves you time and the stress of constantly monitoring.

- Not to worry about market swings.

-

Affordability

- buy shares of large companies.

- Invest in big companies.

-

Liquidity

- Easily move money in and out of mutual fund investments.

- open-ended funds can be redeemed in part.

-

Tax Benefits

- Tax benefits available.

- No tax on capital gains on units of equity schemes.

-

Well Regulated

- In India, all mutual funds are regulated by the Securities and Exchange Board of India (SEBI).

- It follow transparent processes, as laid down by SEBI.

- disclose their portfolios every month.

Why you should choose Investment Banking?

In Today's world Everyone Should Invest In Mutual fund Or any Type of Fund So that their Money will not Get Affected By Inflations That Is 4% Per year. And The Percent Matters A lot. In Fixed Deposit or Recurring Deposit In A Bank With Current Interest Rates i.e. 5.50 - 6.50 The Estimated return Value For a year Would Be 1,04,500. Approx Respectively. And If You Invest In Share,Stocks,Mutual Funds The Returns may Upto 8% that is almost Twice Of Bank Interest.

OUR SERVICES

Research

Best Stocks And Shares , ETFS, Mutual Funds

REVIEW

Review From the Individuals About The Market

STUDY

Apply For The Fund As Per Review

COMPANY PROFILE

Your Trust Is Our Responsibility

AGENT INFORMATION

We Give Call According To Our Agent Information

EMAILING

Approved Call Of The Customer Will Be Email To Agents

OUR VALUES

IBH

A Firm That will Help You Grow Together

SUPPORT

We Support Our Client To Achieve Their Financial Goal

CHAT 24/7

Our Team Will Be In support For You 24/7

MAILING

You Can Mail Us At Registered E-mail Regarding Any Queries